We make it a point to reconcile the balance sheet accounts every month when we are doing month-end closings. This is important—not only to make sure no income is missing and everything is reported only once. It also matters because it helps you ensure that your receivables and payables accurately match what has occurred in the business. Another way to skip the tedious process is by accepting credit cards or another online payment option such as ACH. Doing so allows you to skip the longer workflow because each transaction gets processed as a single transaction, meaning there’s not a chance for it to show up as a lump sum payment on your bank statement.

LeanLaw introduced the option to deposit trust paid invoice payments & deposits into undeposited funds. Think of the Undeposited Funds account as an envelope or desk drawer where you keep checks until you take them to the bank. If you receive more than one check or payment in a day, you may want to group them all into one deposit. You want to enter those transactions so that your Quickbooks Online Bank Register matches your Bank’s monthly statement. When you put money in the bank, you often deposit several payments at once.

In that case, you can take advantage of ReliaBills, and its top-notch recurring billing feature to make your billing process easier and more efficient. Continue entering payments received from your customers until all payments have been entered. In order for your financial statements to be accurate for the year, you need to record the payment as being received on Dec. 31. However, the payment will not clear your bank until Jan. 2 of the next year, at the earliest. Let’s say your customer sent you a check for services rendered. You received the check on the last day of the year, which happened to be a Saturday.

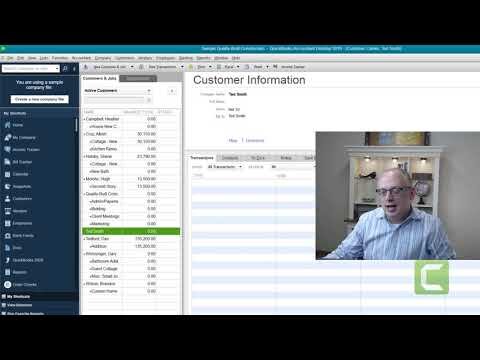

But clearly, these items from 2017, didn’t go into the checking account. And what we’re going to do is we’re just going to make a fake bank account just so we can clear out this function and the undeposited funds. So I’m going to call it the ‘undeposited clearing’ for the sake of calling it anything. What I’m doing now, setting up an account is something you can also do through the chart of accounts. So for this example, we’re sitting with undeposited funds of $33,500.

How Do I Unassociate an Email Address With Facebook?

Undeposited funds account in QuickBooks is used to hold invoice payments and sales receipts you wish to combine. Know How to Clear or Delete the Undeposited Funds from the Bank Deposit. You receive a check from a customer, post the payment and set the check aside. You don’t make it to the bank that day and instead deposit the initial check along with two others the following day. Two of the three checks were deposited to funds and the other directly to the bank account.

- If you have old transactions in your undeposited funds, this may have happened from a data transfer from QuickBooks Desktop, or another accounting program the quick way may be an option.

- If you, if this account, or back in the balance sheet of the account, it’s increasing and not clearing down to zero regularly, it’s a good idea to check out what’s happening.

- Here’s what you need to know about QuickBooks Online’s Undeposited Funds account to keep your business accounting operations running smoothly.

- Therefore, this simple error required the business to pay taxes on $850,000 of additional income that had never been received.

- Once the funds are deposited, the balance in the Undeposited Funds account is reduced to zero.

So, you need to combine your five separate US $100 records in QuickBooks to match what your bank shows as one US $500 deposit. Undeposited Funds is simply a holding account that tracks payments received from customers that have not been deposited to your bank account. In order to clean up undeposited funds in QuickBooks, generally two kinds of methods are used.

Now if there are a lot of old entries in your QuickBooks undeposited fund account, then you would like to clean up these entries, it is recommended that you apply the utmost care Retained Earnings: Entries and Statements Financial Accounting while doing this. Recurring billing is the process of automating your payment processing repetitively. Suppose your business offers products or services on a subscription basis.

Posting these payments to the Undeposited Funds account will allow you to correctly record the deposit in QuickBooks Online, making reconciling your bank account easier. Undeposited Funds is a default account in QuickBooks that holds funds from payments to your company until you deposit them to your bank account. You can’t deposit funds directly to Undeposited Funds, because it’s only a temporary account; you can deposit the funds in a single transaction after you take your deposits to your bank account.

Question: Are Undeposited Funds Considered Cash?

LeanLaw introduced the option to deposit invoice payments and trust deposits into undeposited funds instead of directly into the operating or IOLTA bank accounts. Why use undeposited funds vs. depositing directly into your bank account? Reconciliation is also the redundancy that is needed to ensure that no fraud is occurring in your business. Since there is not a bank account that supports undeposited funds or accounts receivables, you need to reconcile these accounts to income received, instead of a bank statement. You must ensure that every valuable penny earned from your hard work has been collected, and nothing more.

The problem comes when people do not realize that QuickBooks saved the sales receipt or invoice payment to Undeposited Funds. They don’t see the amount in their bank account in QuickBooks, so they enter another deposit directly into the bank account. Now the money received has been recorded twice – once to Undeposited Funds and again to the bank account. You have to affect another account besides cash when you enter a transaction. So firstly, I’m going to go through a simplified version of the way to work through clearing undeposited funds correctly so that we properly record everything that’s happened. This is for when you’re doing something in a current year and you want to make sure that all your records are accurate.

Employee Transaction / List

To navigate to the bank feed click Banking in the left-side menu then Banking again. Undeposited Funds is a special holding account within QuickBooks. You don’t need to do this if you’re downloading transactions directly from your bank. Novi AMS associations will notice Undeposited Funds when receiving payments. To use the service, you have to open both the software QuickBooks and Dancing Numbers on your system.

Then match those with records with your bank as needed. Undeposited funds refer to a temporary account used in accounting to track money received by a business but still needs to be deposited into a bank account. It represents payments or receipts that have been received but are awaiting deposit. This account is typically used when a business gets multiple payments throughout the day or week and wants to group them together before making a single deposit. Just remember every time you save a transaction, you are affecting accounts in your chart of accounts. If you want to know which accounts are affected, in QuickBooks Desktop from the sales receipt or invoice payment form click the Reports drop down menu and select the last option, Transaction Journal (or click Ctrl + y).

What is Undeposited Fund?

This is not the case with Undeposited Funds, an account that hides beneath many transactions you make in QuickBooks. This topic will be our last destination for Cash in our Nonprofit Chart of Accounts Grand Tour. Reconciling undeposited funds to payments and accounts receivables will result in the eternal mystery of the undeposited funds account being unraveled, and the riddle being solved. If you are unable to see the option to terminate an employee on your list of active employees on the company payroll, this mostly implies that they have some history.

This account is used to accumulate cash, checks, and credit card deposits you receive before you record them as deposits in your bank account. The purpose of the Undeposited Funds account is to allow you to group deposits in your books in the same way you physically take them to the bank. This makes reconciling your bank account so much easier. Undeposited funds refer to the payments received by a business that have not yet been deposited into its bank account. This account is typically used by businesses that receive multiple payments from customers throughout the day and do not want to make frequent trips to the bank to deposit each payment separately.

After that, apply the filters, select the fields, and then do the export. Save time, money, and your sanity when you let ReliaBills handle your bill collection, invoicing, reminders, and automation.. The “normal” balance for the Undeposited Funds account is $0. If you see a balance in Undeposited Funds on your balance sheet, you need to investigate.

How to Clean up Undeposited Funds in QuickBooks Desktop?

And it’s also why I would suggest not using this method for current, you know, in a current year. We need to take out of this un-deposit clearing account. We’re going to use sales, the income account, and ‘out of scope tax’ because the last thing we want to be doing is messing up old sales tax.

The second one is just going to be a, like, let’s just get rid of this. Particularly if some of these things relate to prior years and you’ve filed your taxes because it’s going to mess up your numbers. But it will get rid of the undeposited funds, so there’s that. Normally every bank type account in your chart of accounts aligns with an actual bank account you maintain at a banking Institution.

If there is, open the deposit window to start a new deposit and see if you see a detail listing of the transactions pending deposit. Hopefully any amounts listed are valid pending deposits and the total agrees to the amount on the balance sheet as of today. See Michelle Long’s video on how to clean up a problem in Undeposited Funds.